“We must recognize that climate change, beyond its environmental dimension, also constitutes a social, economic, and financial challenge, which calls for urgent actions to mitigate its effects. It is therefore essential for our countries to explore innovative approaches to reduce investment risk and create an environment conducive to green and sustainable investments,” Mr. Bouazza said on this occasion.

The experience of certain regions, he continued, shows that blended finance and Islamic financial instruments are increasingly being used to address these challenges.

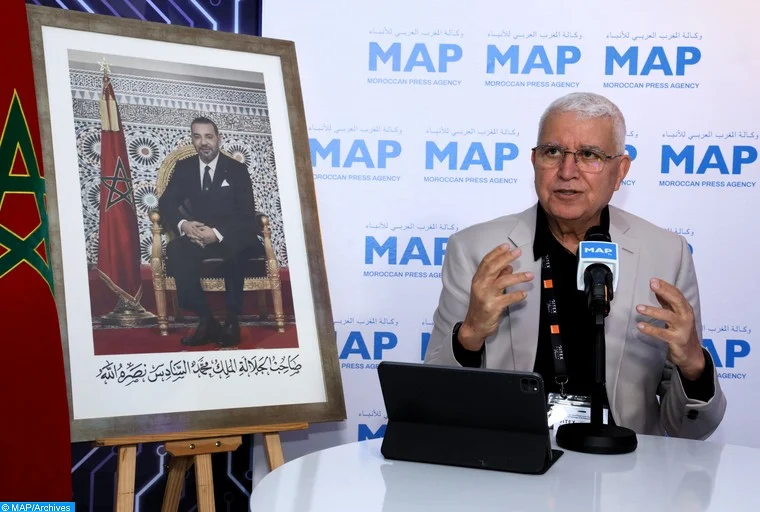

This event was also an opportunity for Mr. Bouazza to share the Moroccan experience, with a particular emphasis on the collaboration between the state, financial authorities, and the financial sector to establish a climate finance development strategy.

This strategy serves as a foundation for mobilizing the necessary capital for sustainable financing and is based on five objectives, namely, financing green projects through public-private partnerships, improving the management of natural disasters and protection, adapting fiscal policy to support the ecological transition, establishing a green taxonomy, and managing financial risks related to climate impacts, he recalled.

And he added: “Regarding this last point, Bank Al-Maghrib has issued, since 2021, a series of guidelines requiring banks to integrate climate risks into their risk management policies, to report to the central bank their exposure to climate-related risks, and to publish information on governance, risk management, and the decarbonization of their portfolios.”

The DG of BAM also emphasized the importance of overcoming several challenges to make progress on the regulatory front.

These include the lack of granular and frequent data on the geographical location of assets and on the classification of economic activities, as well as the need to deepen models to better understand the interactions between the real economy and the financial sector, and vice versa, he noted, estimating that on all these issues, international partners have a key role to play in achieving the set objectives.

In this regard, Mr. Bouazza praised UNEP-FI, which facilitated a fruitful collaboration in 2023 with Bank Al-Maghrib, banks, and public actors, to examine the barriers and levers to private investment for climate, and to explore financing and partnership models to catalyze private investment in green projects.

Dedicated to sustainable finance in Africa and the Middle East, this round table served as a platform for exchange among stakeholders (financial institutions, central banks, international financial institutions, donors, and experts) who discussed, among other things, the levers for promoting sustainable finance and cooperation in the face of critical climate challenges.